The real reasons stores such as Nordstrom, CVS and Starbucks are closing in big cities

Nordstrom. Walmart. Whole Foods. Starbucks. CVS.

These big chains and others have closed stores in major US cities recently, raising alarm about the future of retail in some of the country's most prominent downtowns and business districts.

Several forces are pushing chains out of some city centers: a glut of stores, people working from home, online shopping, exorbitant rents, crime and public safety concerns, and difficulty hiring workers.

To reinvent downtown retail, drastic changes may be required.

That means denser neighborhoods with a broader mix of affordable housing, experiential retail, restaurants, entertainment, parks and other amenities, which won't happen overnight.

"Once [these cities] become true urban neighborhoods, then you will find retailing start to come back in different ways and forms," said Terry Shook, a founding partner at consulting firm Shook Kelly.

How policymakers remake their downtowns - with retail as a crucial attraction - will be crucial to cities' fiscal health and regional economies.

A glut of stores

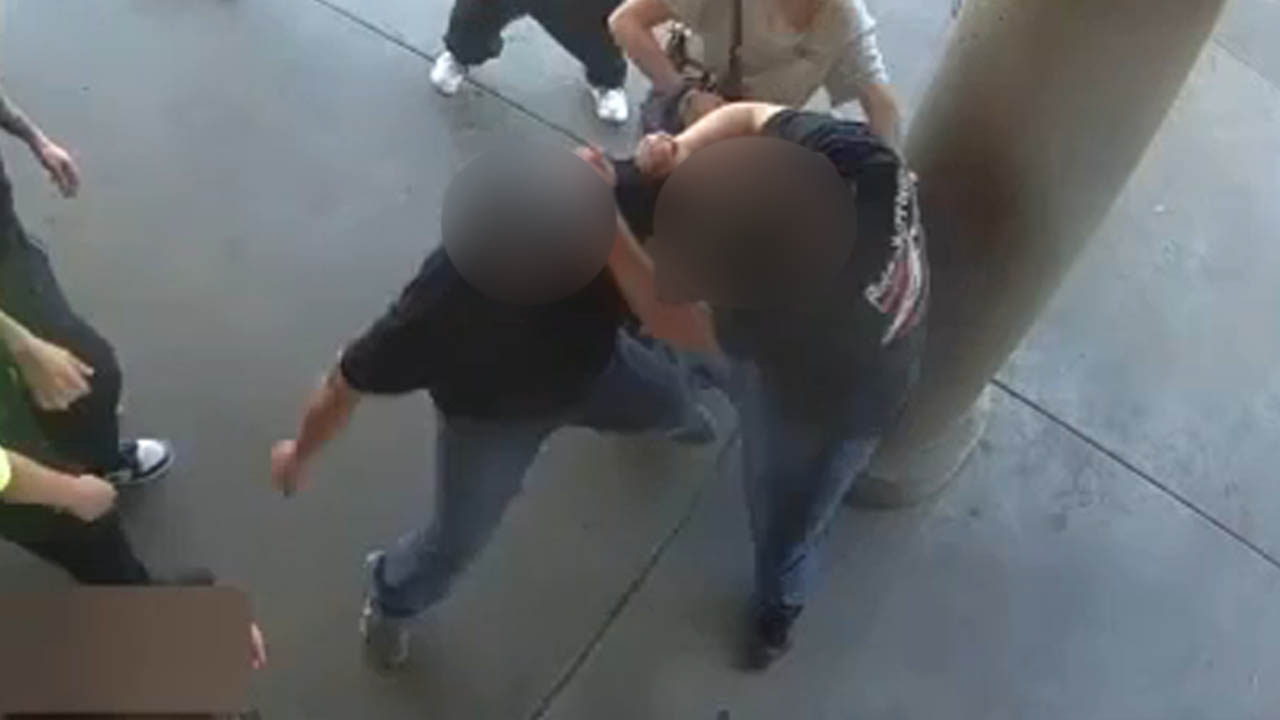

Some of those policymakers, including both Republican and Democratic leaders, have pointed to crime as a chief reason for the closures, following videos of brazen shoplifting incidents.

"We're losing chain stores that are closing down. People who are being employed in those stores are losing their jobs" because of crime, New York City Mayor Eric Adams, a Democrat, said in February.

But the impact of shoplifting may have been overstated in some cases.

Walgreens said it saw a spike in losses, known as shrink, during the pandemic and cited organized retail crime in its decision to close five San Francisco stores in 2021. But it recently backtracked.

"Maybe we cried too much last year" about shrink numbers, a Walgreens executive said in January.

And instead of a strong correlation with crime rates, the closures aren't also a recent phenomenon.

San Francisco, Los Angeles, San Diego, New York City, Seattle, Miami and Chicago lost retail stores from the beginning of 2017 to the end of 2021, according to research from the JPMorgan Chase Institute, a think tank.

What's more, experts agree, the closures aren't just about crime. Several trends have converged to put these stores at risk.

Perhaps most key is the glut of stores in America.

According to Morgan Stanley, from 1995 to 2021, more stores closed every year than opened. The trend became popularized as the "retail apocalypse."

So while the big-city closures may capture national attention, in reality they're often part of closures a brand implements across the nation.

"The logic of big box retail, period, is much weaker than it was 20 years ago or even 10 years ago," said David Dixon, an urban places fellow at Stantec, a global design firm.

For example, Walmart has shuttered about 40 stores since 2021 and will close 20 this year. Nordstrom will shut down 15 locations in 2023.

CVS also announced in 2021 that it will close 900 stores over three years.

Remote work

Even at stores still in city centers, fewer people are often shopping.

One major factor here is the pandemic-fueled shift to remote work: Between 2019 and 2021, the number of people primarily working from home tripled from around 9 million people to 27.6 million people, according to the Census Bureau.

The rise of remote work has damaged urban downtown shopping areas, which were designed to cater to office workers commuting back and forth daily.

The typical office worker is now spending about $2,000 to $4,600 less per year in city centers, according to research from Nicholas Bloom, a Stanford University economist.

They're shifting that spending to the suburbs, as 1 million people also left city centers during the pandemic, he said.

Retailers have followed this shift.

They left more expensive cities like San Francisco and New York and headed to cheaper Sun Belt cities such as Phoenix and Houston, the JPMorgan Chase Institute found.

San Francisco lost around 6% of its retail establishments from 2019 to 2021, according to the think tank's research. Los Angeles lost around 4% and New York shed 3%.

Meanwhile, Houston and Phoenix gained 4% new retail establishments during that stretch.

Online shopping

Retail stores are also under pressure from the continued shift to online shopping.

E-commerce made up 14.7% of all retail sales during the final quarter of 2022, according to the Census Bureau. The pandemic accelerated that growth.

For example, chain-store closures in New York City have correlated to the products most frequently bought online. Clothing, shoes, accessories, vitamins and electronics stores have fared the worst, said Jonathan Bowles, the executive director of the Center for an Urban Future, a public policy think tank.

And though crime isn't the biggest factor in many cases, higher levels of shoplifting and other losses have taken some toll.

Retail shrink hit $94.5 billion in 2021, a 53% jump from 2019, according to the National Retail Federation's annual survey of around 60 retail member companies. (The largest contributor to shrink is customer theft, but the metric also includes employee theft, human errors, and other losses.)

Finally, struggles to recruit workers at higher wages and punishing rents in cities have contributed to retail closings.

In San Francisco, the average rental price listed by landlords during the first quarter of 2023 was $43 per square foot, nearly double the national average, according to Cushman & Wakefield data. In New York, it was $32 per square foot and $33 in Los Angeles.

In cities where retailers are growing, such Phoenix, Houston and Dallas, average rental prices were $22 and $23 per square foot.

'Downtown is for People'

There's no easy fix to slow the exodus of retail chains from cities.

Replacing a Nordstrom with another department store, or swapping out a CVS for a different drug store chain, is unlikely to be sustainable, experts say.

"It's a really tough problem for cities and economic developers," said Chris Wheat, the president of the JPMorgan Chase Institute. "How do you make these live, work and play neighborhoods? That was a question before the pandemic, but it's become more salient now."

It hearkens back to urbanist Jane Jacobs' influential 1958 essay "Downtown is for People," in which she argued a vibrant street life was crucial for neighborhood safety and community.

It is this model, focused on the vitality of the streets and the people who inhabit them, that's needed to create lively and exciting communities and shopping areas.

Streets could be blocked to cars on weekends and other hours. Cities can also host street fairs, food festivals, live music, art exhibits and other events to draw foot traffic downtown.

These so-called "placemaking" investments -which Bowles notes are "not massive, billion-dollar" invesments - could be supported by special business improvement districts, where local stakeholders fund the maintenance and promotion of the area.

Bringing streets to life

If the future of shopping is not giant department stores, a wider mix of stores will be needed to make downtowns more appealing.

Traditionally, retail landlords seek out the longest leases. But that makes it difficult for new stores to open.

Cities can provide financial incentives to encourage landlords to offer temporary and more flexible leases and loosen regulations to speed up the permitting process for them.

This will allow for pop-up stores, seasonal retailers and a mix of food and drink vendors.

"Can retail be more responsive?" said Paco Underhill, the founder of behavioral research and consulting firm Envirosell. "Can you have a space that is Crocs during summer and Canada Goose during winter?"

Then there are more intractable challenges, such as improving public transit and creating more affordable housing in downtown areas.

Zoning laws need to be updated to allow for redevelopment of some vacant office buildings and commercial real estate into affordable housing.

The density of housing that will replace some office and commercial spaces matters, said David Dixon from Stantec. People want to shop just minutes from their homes, and a critical mass of housing is needed to sustain surrounding retailers.

"A vibrant downtown, full of housing, can bring its streets to life," he said. "It's a much larger story than the fate of retailers themselves."

The-CNN-Wire™ & © 2023 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.